tax on forex trading philippines

At the same token you can also go from 100 to 0 in one unfavorable tick. Understanding forex trading taxes.

Gold Vs Currency The Pure Gold Company

Speculative trading considered to be similar to betting activities.

. The answer is positive. IM Academy Forex Trading was created in 2013 as a small start-up by Christopher Terry an independent businessman and Isis de La Torre who is an experienced Forex expert. Trading forex currencies in the Philippines is popular among residents.

Therefore this system is preferred by large-volume Forex traders. On October 30 2018 the Philippines Securities and Exchange Commission SEC Issued its latest advisory stating categorically that Forex Trading Is Illegal In The Philippines For Context here are the highlights of that advisory. Jan 17 2012 1041 AM.

The gains tax rate is 20 on 60 of the gains or losses. Tax in Philippines for Forex Trading. This is of course different in every country and in some countries you do not pay tax also called a traders paradise.

You can go from 0 to 100 in one favorable tick. At the same time in the EU due to the ESMA rules leverage is limited to 301. Foreign Exchange Currency Trading or Forex Trading is the Fast and the Furious of high-level finance.

Senate of the Philippines. Best Broker MT4 Forex Trading Platform in Philippines. As ferrarieverest said you can easily offset it with corresponding expensesbe creative.

Apart from these GST implications forex traders must also pay charges. Online Forex trading Philippines has become quite popular among traders with higher risk appetiteThats the reason many Forex Brokers have now registered themselves with Philippines authorities recently. Office of the Vice President.

Experience Live Trading in a User-Friendly Trading Room. As such Option Robot has a lot of lucrative offers to make you earn higher profits in a small Forex Tax Philippines span of time. It is legal to use in the Philippines.

Jmiyake on Jan 17 2012 1001 AM. Once a traders profits reach a level where the income on the Forex trading can be taxed in Philippines the trader should make sure all taxes owed for a financial year are paid. Find an online forex broker that is licensed to operate in the Philippines.

On the other hand for those traders whose other sources of income exceed 518400 the effective capital gains tax will be 37. Use a device that offers you Internet access. The income generated from outside sources is also taxable in the country.

In time IM. If you are classified under this category then gains earned from forex trading are not subject to income tax business tax or capital gains tax. If youre from the Philippines the FX market opens 5 AM on Monday and closes 5 AM on Saturday.

This serves as a great advantage for traders who have fulltime jobs. If trading in forex is a business for the trader the income arising from it will be taxed as business income. January 10 2019.

It is an investment where you. It is stated naman kung saan nanggaling ang pera mo transaction details. Saxo Bank - Best web-based trading platform.

Forex Tax Philippines trading platform for yourself then try out Option Robot. AvaTrade - Great for beginners and copy trading. Here the gains tax equals the traders ordinary income tax eg 37.

Or nagsasabi na broker daw sila and they will trade for you. Php53000 50000 his initial investment. Everyone out there wishes to be successful in binary trading.

The tax amount is 18 of the taxable value so the final GST amount falls between Rs 990 and Rs 60000. Forex Taxes in the Philippines. Gain Access to A Wide Range of Assets.

The aim of the academy was to provide individuals the skills and knowledge needed to trade in the foreign market for currency. Nevertheless as the income is not taxed you are not entitled to claim potential losses. Here is the maximum capital gains tax rate for individuals in some countries.

Therefore the total amount which should be paid in taxes will be 30000 x 022 which is 6600. You can test the free demo account offered by Option Robot to test the. Forex Taxes in the Philippines.

It is up to you to declare or not as personal income. Greater than Rs 10 Lakh. Open a margin account.

Otherwise it must be taxed under income from other sources at the rate applicable to individuals. The taxable value of transactions of more than Rs 10 Lakh is Rs 5500 01 of the transaction amount. Taxpayers who fail to secure a TRC shall not be allowed to claim foreign tax credits in excess of the appropriate amount of tax that is supposed to be paid in the source state had the income recipient invoked the provisions of the treaty and proved hisherits residency in the Philippines Section 5 Revenue Memorandum Order No.

The rest of the profit is regarded as money from short-term activities. You have to learn to trade on your own kasi marami namang educ materials and tutorials for free. It is usually taxed the same way as Capital gains.

It has created account types for every type of trader. My answer to that is yes also a Forex Trader pays taxes on his earned assets. Do you have to pay tax on income from Forex trading in the Philippines.

Traders often wonder whether forex trading is subject to taxation in the Philippines. Tax On Forex Trading Philippines. But please dont subscribe to people who are trying to sell you courses for expensive prices.

FOREIGN EXCHANGE TRADING IS ILLEGAL IN THE PHILIPPINES. Unlike stock market exchanges like PSE Philippine Stock Exchange the forex market is open 24 hours a day 5 days a week.

Best Forex Broker Philippines 2022 Top Ph Forex Brokers List

What Is Isr Tax An Vicitm Was Cheated 1 000r By Expert 24 Trade Wikifx

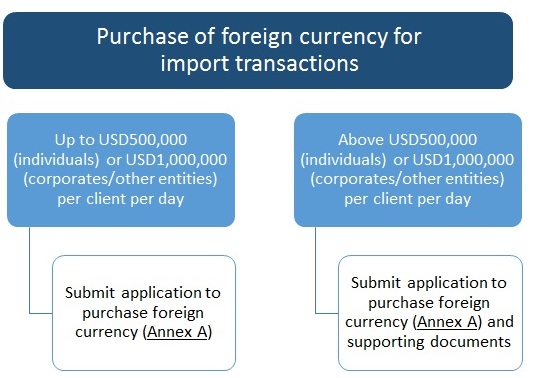

Bangko Sentral Ng Pilipinas Foreign Exchange Regulations Guide To Fx Transactions

Is Forex Trading Legal In The Philippines Forextraderph Com

How Are Forex Gains Taxed Fair Forex

Forex Trading Academy Best Educational Provider Axiory Global

Forex Trading In The Philippines 2022 The Only Guide You Need

/dotdash_Final_Why_the_Forex_Market_Is_Open_24_Hours_a_Day_Sep_2020-01-d2b1c5295a0b4d7a8df8eb057505efb3.jpg)

Why Is The Forex Market Open 24 Hours A Day

Trade Forex Safely Protect Your Forex Trading In An Offshore Company

Forex Trading Academy Best Educational Provider Axiory Global

Best Forex Broker In India 2022 Top Indian Forex Brokers

Forex Trading Academy Best Educational Provider Axiory Global

Code Of Conduct For Forex Traders In The Works Philstar Com

2019 Forex Trading In The Philippines What Is Legal What Is Not Forex Club Asia

Forex Trading In The Philippines 2022 The Only Guide You Need

:max_bytes(150000):strip_icc()/dotdash_INV_final-Where-Is-the-Central-Location-of-the-Forex-Market_Feb_2021-bda66f26d44b4fe59da8e2b2eb425c00.jpg)

Where Is The Central Location Of The Forex Market